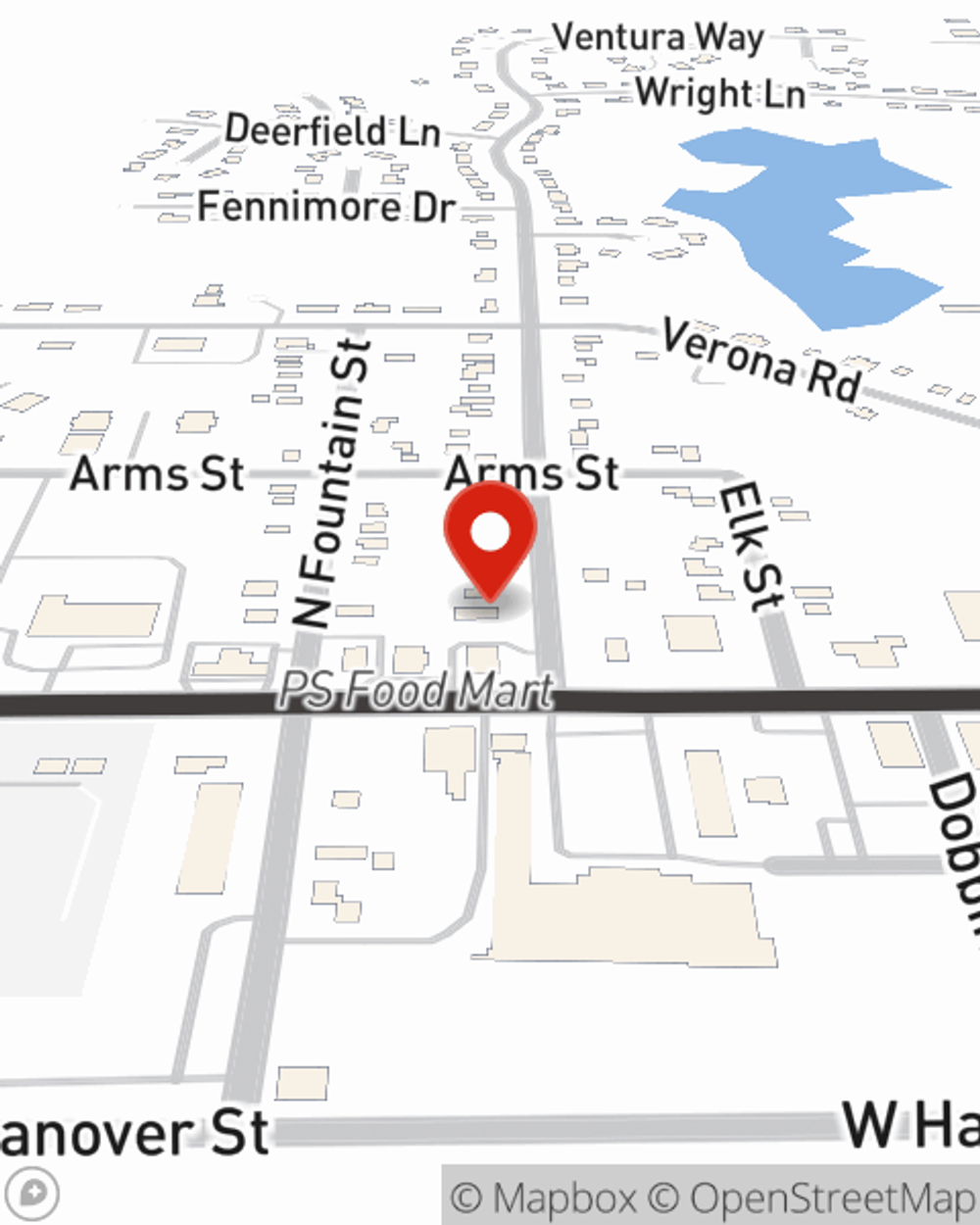

Renters Insurance in and around Marshall

Welcome, home & apartment renters of Marshall!

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Marshall Michigan

- Battle Creek Mi

- Bellevue Mi

- Homer Michigan

- Tekonsha Mi

- Ceresco Mi

- Burlington Mi

- Olivet Mi

- Charlotte Mi

- Springfield Mi

- Kalamazoo Mi

- East Leroy Mi

- Athens Mi

- Eaton Rapids Mi

- Sherwood Mi

- Litchfield Mi

- Coldwater Mi

- Albion Mi

- Jackson Mi

- Union City Mi

- Colon Mi

- Jonesville Mi

- Springport Mi

- Parma Mi

Home Sweet Home Starts With State Farm

Home is home even if you are leasing it. And whether it's a condo or an apartment, protection for your personal belongings is beneficial, even if your landlord doesn’t require it.

Welcome, home & apartment renters of Marshall!

Coverage for what's yours, in your rented home

Renters Insurance You Can Count On

Many renters underestimate the cost of refurnishing a damaged property. Your valuables in your rented townhome include a wide variety of things like your exercise equipment, set of golf clubs, set of favorite books, and more. That's why renters insurance can be such a good idea. But don't worry, State Farm agent Lisa Sands has the personal attention and dedication needed to help you understand your coverage options and help you protect your belongings.

A good next step when renting a residence in Marshall, MI is to make sure that you're properly covered. That's why you should consider renters coverage options from State Farm! Call or go online now and learn more about how State Farm agent Lisa Sands can help you.

Have More Questions About Renters Insurance?

Call Lisa at (269) 781-8668 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.